Bitcoin Under Pressure! Analysts Say “Risk Continues” – Big Drop Ahead?

Bitcoin Under Pressure! The crypto market is on edge as Bitcoin (BTC) faces intense pressure. Altcoins have followed suit, turning the market into a bloodbath.

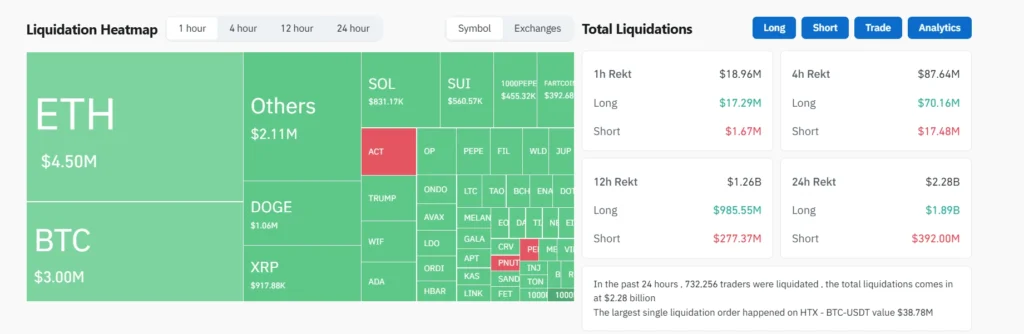

According to Coinglass data, over $2 billion in liquidations have occurred in the past 24 hours. This surpasses liquidations during the COVID-19 crash and the FTX collapse, highlighting the scale of the current decline.

Crypto Market Liquidations (Source: CoinGlass)

🔥 Bitcoin’s Risky Path: Could $75K Be Next?

Market analysts warn that Bitcoin’s decline isn’t over. Data suggests a 22% probability of BTC dropping to $75,000 by March 28, up from just 10% last week.

According to Derive analysts, this increased risk stems from recent U.S. tariffs on Canada, Mexico, and China. The concern? These tariffs could fuel inflation and weaken investor sentiment in crypto.

🌍 How U.S. Tariffs Are Impacting Crypto Markets

The U.S. recently imposed a 25% surtax on imports from Mexico and Canada and a 10% surtax on Chinese goods.

Higher tariffs mean increased costs for businesses and consumers, potentially driving inflation higher. Historically, inflation concerns have hurt risk assets like Bitcoin, as investors move towards safer assets like bonds and gold.

📊 Bitcoin & Geopolitical Events: A Volatile History

Bitcoin has reacted strongly to global events in the past.

- In 2020, Bitcoin crashed during the COVID-19 pandemic, only to surge as governments printed money.

- In 2022, Bitcoin dropped after the Russia-Ukraine war heightened market fears.

- Now, rising tariffs could be the next trigger for a BTC price correction.

🚀 Spot ETF Approvals: A Potential Lifeline?

Not all news is bearish! Major players like Bitwise and Grayscale are pushing for spot ETFs for DOGE, SOL, XRP, and LTC.

If the SEC approves these ETFs, it could legitimize the crypto market and attract institutional investors, helping BTC regain momentum.

🔎 Arthur Hayes: $75K Before the Next Bull Run?

Former BitMEX CEO Arthur Hayes predicts that BTC will first drop to $75,000 before rallying in a major bull run.

His reasoning? Market corrections are healthy before a big price surge. Investors should brace for volatility but keep an eye on long-term trends.

📈 What’s Next for Bitcoin?

- If tariffs worsen inflation, BTC could fall further.

- If ETF approvals go through, it could spark a recovery.

- Technical indicators suggest BTC is at a critical level.

With Bitcoin under pressure, traders should stay informed and manage risks wisely. Will BTC drop to $75K or recover soon? The coming weeks will be crucial!